Organic growth is a distant memory for many companies. Markets in the first world are mature and the whitespace they contain has already been claimed. The only new business many companies can expect to find is the business they steal from someone else. This trend has driven many organisations to turn to the relatively undeveloped emerging markets – the BRIC{{1}} nations in particular – or acquisition for the majority of their growth. The problem, however, isn’t the lack of white space; with markets constantly evolving, driven by technology and fashion, new white spaces are constantly bubbling in and out of existence. The problem is that our current, monolithic business models, cannot fit into these new white spaces,

[[1]]BRIC: Brazil, Russia, India, China[[1]]

Business growth comes from one of two directions: either organic growth, or by acquisition. You can buy a plot in the mother land, or you head out into the undiscovered countries to find a plot for your own. Much has been written about both of these approaches.

Competitive business strategy – the art of stealing someone else’s plot – has been refined to a fine art. With our five forces{{2}} strategy maps{{3}} and scenario planning{{4}}, we have a range of tools at our disposal with which we can map out the opportunity, determine our strengths, measure the weaknesses of our competitors, and plan our attack. Competition has become quite bloody, with the major players in each industry and market evenly matched. For all their efforts, most businesses can only tweak their share of the market a few points either way, while their year-on-year performance dominated by the performance of industry as a whole.

[[2]]Michael E. Porter’s five forces discussed @ Wikipedia[[2]]

[[3]]Strategy maps discussed @ Wikipedia[[3]]

[[4]]Scenario planning discussed @ Wikipedia[[4]]

The last gasp of this approach was the idea of blue oceans{{5}}. If the ocean where you’re paddling is red with the blood of your competitors, then perhaps its time to find a patch of clear blue ocean where you can paddle unmolested on your own. This is an approach that Nintendo used to great effect. Nintendo decided not to compete directly with Sony and Microsoft in the battle for the home gaming console. The market was dominated by Sony and Microsoft, each investing heavily to try and improve the graphics of their next generation console to give a more realistic (and violent) experience. Instead, Nintendo chose to focus on casual games (first needing to invent the concept of casual games) which had a wider appeal than the core gamer market. These are game that are easy to pick up and put down, games which much broader appeal than the first-person shooters which dominated the market at the time, and game which the core gaming market derided as simple and uninteresting. Casual games made Nintendo the most profitable company per employee in the world (beating even Goldman Saches at their peak) for a brief period of time.

Since Nintendo and the Wii, the pace of business has accelerated (again), driven by globalisation and cloud computing. Nintendo took several years to develop one market defining product, and is now struggling with it’s next move and the market for casual games is leaving it behind. Younger companies like Zinga swooping in with lower cost, online games to steal much of the market for casual games. The opportunity to move sideways and find new blue oceans is becoming rarer, as the rapid pace of business means that you often find that the patch of blue ocean that you were paddling for is as red as the patch you left, as many of your competitors saw the same opportunity. The whitespace is – in effect – drying up.

With organic growth into the white space a distant memory the first work, many companies are turning to the developing work – the BRIC nations in particular – to try and grown their revenues. Find a country further back on the development curve and peddle you weres there, where the is no (or, at least, little) sophisticated competition. There are some hurdles to overcome, such as the fact that we need to package our toothpaste and mouthwash in sachets, rather than large tubes and containers, but the white space seems to be there for the taking.

Globalisation is a double edged sword though. Not only does it allow you to sell your goods in every nook and cranny around the planet, to also allows the local companies, the companies in those nooks and crannies, to leverage the best expertise and suppliers from around the world to service their local market. While the world might be flat, it is also spiky and local knowledge counts. Western companies are finding that they are increasingly beaten to the punch by a more agile and knowledgeable local. The developing world is developing a lot faster than many of us expected.

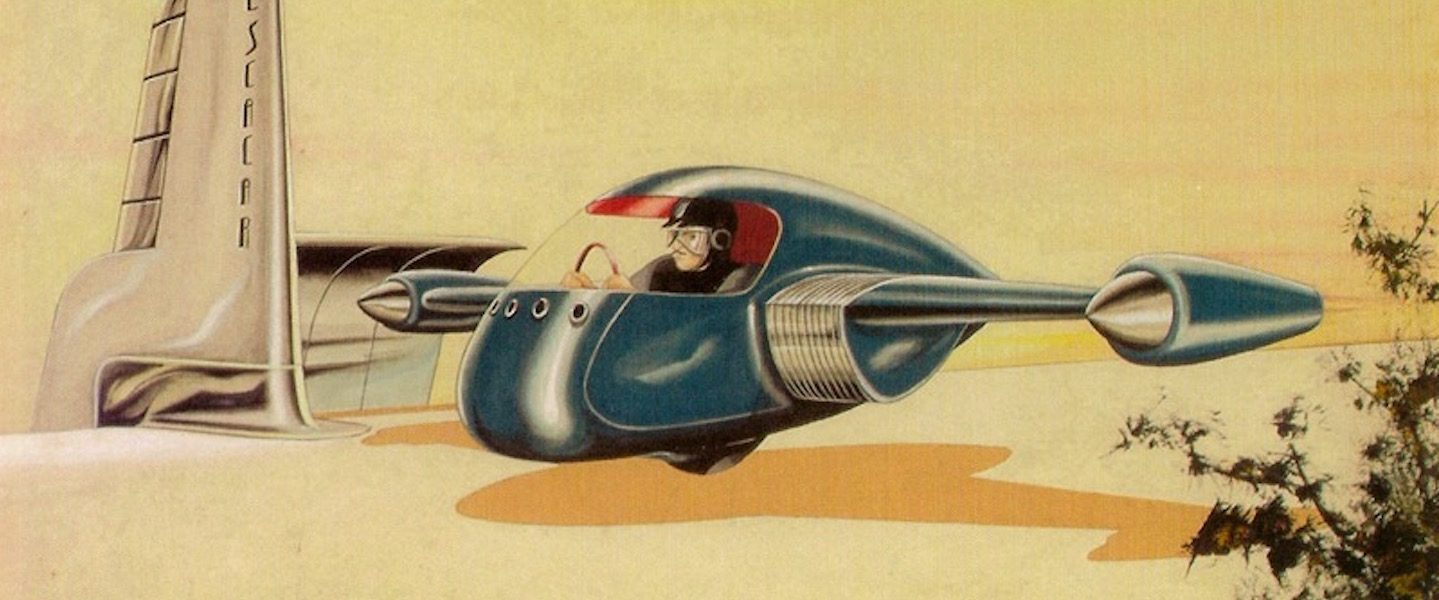

The white space, however, is not completely filled: the circle that is the market has a well-defined centre but no discernible circumference, and new opportunities are constantly popping in and out of existence around it’s edge. Rapidly evolving circumstances and changing fashions are creating new market opportunities, new white space, as customers realise that they have an unfulfilled need. The problem is that our existing businesses can rarely fit into the holes these opportunities provide. Conceived as vast machines, our businesses are built around powerful engines, with each piece turned to provide optimal performance. While this might provide our businesses with power, it also makes them cumbersome. They’re the muscle car from the seventies: fast in straight line, but corner like the titanic. We’re usually still madly tugging on the tiller trying to turn the ship when the opportunity evaporates back into the ether it came from.

The challenge is to change the way our businesses behave – how they use assets and people, their processes and governance – so that they can fit into these new white spaces. Delta Motorsport{{6}}, for example, approached the process of designing a new car from an unconventional direction. Locating themselves near Silverstone in the U.K., among the various Formula 1 teams and (more importantly) the community of contract manufacturers that surround these teams – Delta was able to design the E-4 Coupe, a 150mph (241kph) electric sports car, for the tiny budget of £750,000 and with just ten employees. They expect that they can move the car into production for an additional £4.5 million, a fraction of the $1 billion, and in a fraction of the time or more required via a more conventional approach.

[[6]]Viknesh Vijayenthiran (May 2011), Move Over Tesla, Delta Motorsport Launches 150 MPH E-4 Electric Coupe, Motor Authority[[6]]

The market is fragmenting as companies such as Delta Motersport, Megabus{{7}} and Kogan{{8}} create business models which enable them to fit into these new white spaces. In some instances these white spaces sit beside existing market, providing new products and services to customers who were previously left unsatisfied. At other times the bubbly edge drains away soft centre, as the white space provides new products and services for customers who used to settle for something else.

[[7]]Ben Austen (April 2011), The Megabus Effect, Businessweek[[7]]

[[8]]Kogan Electronics[[8]]

Colonising the new white spaces requires us to approach our businesses from a different direction. Rather than think about our business as a statically configured and optimised machines – Henry Ford’s production line writ large – we need to consider our business as more flexible, dynamically optimised vehicles. Optimising internal systems and processes no longer provide us with a competitive advantage. We need to reorient out teams externally, intent on understanding the environment that is unfolding around us and driving the business forward. We need to streamline the controls, the accountabilities and processes we use to operate the business, ensuring that it is easy to enact any decision once it is made.

The challenge today is to understand where to find these new white spaces, and to build up a playbook of tactics which informs us on how to leverage the plethora of on-demand capabilities (BPO, cloud, SaaS, globalisation …) available to us today to reshape parts of our business to fit into the tightest white space.