The global financial crisis hit nearly four years ago in 2008 but America and Europe appear to still be stuck in the mud. Even the Asian market has softened. But is this a recession? Or are we seeing a reconfiguration of the economy as the technological seeds laid over the last few generations finally germinated and bear fruit? Prices for made goods are collapsing as the cost of manufacturing has plummeted, while the cost of sourcing and distribution has crashed, caught between globalisation and the Internet. Even innovation, the source of all those sexy new products, has been democratised with the investment required to development new products taking a nosedive. Our existing business models were not designed to thrive, or even survive, this this environment. While the current market is a challenge to navigate, a lot of the problems we're seeing could be result of a collapse of antiquated business models rather than the collapse in demand that these businesses are intended to service.

The iPhone is a fascinating product. It was deemed a failure at launch, with analysts claiming that it was under powered and feature poor. It also emerged at roughly half the price the analysts expected. Fed into Apples impressive cross-channel marketing machine, some models were available in store while the full range (including engraving) was only available online. Launched in 2007, the iPhone, however, has become one of the key products that powered Apple to the largest quarter in the company's history, with US$46 billion in revenue and US$13 billion in profit{{1}}. A huge success by any measure.

[[1]]Apple Inc. Q1 2012 Unaudited Summary Data[[1]]

At the same time as Apple was rocketing up the global league tables we've been seeing retailers slashing costs and closing stores as revenues collapse. Book shops{{2}}, clothing chains{{3}} and even electronic retailers{{4}} are putting their businesses to the knife. Some of this is due to softening demand. However, there appears to be two much larger trends which might have the lion's share of the blame. Otherwise how do we explain why consumers keep buying all those iPhones?

[[2]]Eli Greenblat (February 17 2011), Borders, Angus & Robertson go bust, The Age[[2]]

[[3]](January 31, 2012), Gasp at risk of folding, Herald Sun[[3]]

[[4]]Shane Fowles (February 1, 2012), Geelong workers sweat as 100 Dick Smith stores to close, Geelong Advertiser[[4]]

First, prices for manufactured goods have crashed, driven down by competition and plummeting manufacturing costs. We've spent our time since the Industrial Revolution automating production, driving out waste and cost by systematising manufacturing and assembly, and then replacing people with machines. You can see this at the top end, where Apple introduced the iPad for US$500 rather than US$1000 as the analysts expected. At the bottom end we have the discount electronic brands who and providing you with basic but functional electronic goods at astoundingly low prices: DVD or MP3 players for less that $20{{5}}, for example.

[[5]]Toshiba SD4200 Digital Progressive Scan DVD Player, Black. AU$17.74 @ eCrater[[5]]

Second is the collapse of distribution as a source of business differentiation. A dirty secret of many businesses is that their entire value proposition has built around distribution: finding a product and moving it from source to customer. Thriving businesses were built on the back of this arcane art. Globalisation and the Internet, however, have democratised distribution, enabling anyone with a web browser to find and source the things they need (or just want), regardless of where on the planet these products are located.

We're seeing a phase shift in the way the market operates. Consumer behaviour is changing as they take to Internet to seek out the best or the cheapest they can find globally{{6}}, creating a vortex in the mid-market which is sucking the life out many well established brands{{7}}. At the same time many local high street retailers – department stores, clothing retailers and the like – are crumbling{{8}}, squeezed between consumers who are shifting their shopping habits online, on one side, and dropping unit prices on the other, pushing down revenue for those sales that they do manage to capture. Traditional retailers are suffering, and we've just had worst Christmas shopping season since 1984{{9}}. At the same time online retailers are seeing record-breaking sales{{10}}, as are manufacturers such as Apple. Companies which have adapted to this new environment are thriving; others just seem to be withering away.

[[6]]Andrew Fraser (May 27, 2011), Click goes the retail revolution, says Morphet, The Australian[[6]]

[[7]]Greg Roberts (December 8, 2011), Administrators try to save Fletcher Jones, Herald Sun[[7]]

[[8]]Martin Farrer (February 3, 2012), Game Group to offload overseas shops as UK sales plunge, The Guardian[[8]]

[[9]]Chris Zappone (February 6, 2012), Retail sales in worst showing since 1984, Sydney Morning Herald[[9]]

[[10]]Jason Jeffries (January 13, 2012), Record-breaking online sales for Christmas 2011, eWay eCommerce News[[10]]

- Supplier Power. A strong distribution network destroys supplier power, as suppliers must go through the distributor to sell to the distributor's customer base

- Customer Power. Customers stick with the distributor as it's to hard for them to find and source products themselves

- Threat of New Entrants. The threat of new entrants is diminished, as it's nearly impossible for a new competitor to build a better distribution network without anyone knowing

- Threat of Substitute Products. Products don't even need to be particularly good, as the challenge of actually getting products in front of customers makes the distributor king

- Industry Rivalry. Distribution-based barriers tends to produce equilibriums for the existing players, as any improvement in one network is quickly copied by the others

[slideshare id=10669987&doc=blogversion-111222161020-phpapp02]

The Internet changed everything.

- Supplier Power. Suppliers can approach customers directly, and now play distributors off against each other to push margins down

- Customer Power. Customers can access a large number of alternatives, some of which are free

- Threat of New Entrants. Content costs, and not distribution costs, are now the barrier to entry

- Threat of Substitute Products. Finding superior content products is easy

- Industry Rivalry. Suppliers have become rivals, with companies such as Apple now engaging consumers directly

Louis CK, an American comedian, conducted a distribution experiment recently. He offered a self-produced video of live stand-up as a download on his website for the low price of US$5{{13}}. Handing over $5 provided you with a login allowing you to download a DRM-free video file. The video cost US$170,000 to produce (largely paid for by ticket sales at the shows which were recorded), with another US$32,000 going into the development of the web site. Twelve hours after the video was announced 50,000 people had bought it, earning Louis $250,000. Four days in it was 110,000 copies, over $500,000. After twelve days sales had hit one million dollars. This is quite a contrast to a traditional Hollywood distribution model, which would have seen the show commissioned, physical DVD (or even video cassettes) printed and shipped and a marketing campaign run. The middle men – the studios and their distribution networks – had been cut out, putting the creator of the content in control

[[13]]Louis CK: Live at the Beacon Theatre[[13]]

New distribution models are emerging, and these models are not simply cheaper and more efficient versions of the models of the past. They're different, and they require a new approach to how we package and price our products. Valve, a video game company, has developed a new distribution platform called Steam. Steam has been called the iTune of video games, as it allows customers to create an account, buy games, and then download these games to any computer associated with the account. What's interesting is that Valve have been using Steam to experiment with the economics of video games{{14}}, and they've discovered a few interesting things.

[[14]]Todd Bishop (October 23, 2011), How Valve experiments with the economics of video games, GeekWire[[14]]

First they discovered that piracy is not a pricing issue. It’s a service issue. As Gabe Newell said in a recent interview:

The easiest way to stop piracy is not by putting antipiracy technology to work. It’s by giving those people a service that’s better than what they’re receiving from the pirates. For example, Russia. You say, oh, we’re going to enter Russia, people say, you’re doomed, they’ll pirate everything in Russia. Russia now outside of Germany is our largest continental European market. … But the point was, the people who are telling you that Russians pirate everything are the people who wait six months to localize their product into Russia. So that, as far as we’re concerned, is asked and answered. It doesn’t take much in terms of providing a better service to make pirates a non-issue.

—Gabe Newell, Valve co-founder

Next they start to experiment with price elasticity. Some initial trials were carried out where prices were varied without any announcements, and Steam enabling them to watch user behaviour in real time. After a baseline was established, and they throught they understood the dynamics of the market, they decided to try a highly promoted sale for a major title.

We do a 75 percent price reduction, our Counter-Strike experience tells us that our gross revenue would remain constant. Instead what we saw was our gross revenue increased by a factor of 40. Not 40 percent, but a factor of 40. Which is completely not predicted by our previous experience with silent price variation. …

—Gabe Newell, Valve co-founder

There's a new dynamic at work here, one driven by global reach and low cost distribution, greased by social media.

Those new distribution platforms are allowing blockbuster games like Call of Duty to rack up one billion in global sales in sixteen days (that's one day faster than it took James Cameron's Avatar to reach the same goal), while games retailers are selling off or shuttering stores{{15}}. Most of the major video game developers are launching their own distribution platforms – such as Origin{{16}} by EA, and the AppStore from Apple – as there is no significant barrier to entry.

[[15]]Keith Stuart & Mark Sweney (December 13, 2011), Modern Warfare 3 hits the $1bn mark in record time, The Guardian[[15]]

[[16]]Origin by EA[[16]]

We're starting to see similar stories with physical goods. BookDepository{{17}} is using cheap and efficient global logistics networks to make it more convenient to buy a book from the other side of the planet than to walk to the local book shop. Kogan{{18}}, an online electronics retailer, has made this into an art from by combining low cost distribution with cheap manufacturing to create an agile, low cost model that might be a signpost of the future.

[[17]]The Book Depository: Free shipping worldwide[[17]]

[[18]]Kogan Technologies[[18]]

Kogan offers customer extremely low cost own-brand televisions, DVD players, digital camera, mobile phones, laptops, etc., delivered direct to the the doorstep. This uses a pull model, where insights from real time Internet search data are used to drive product development. In one instance the company saw a spike in searches for netbooks roughly six weeks before Christmas. Thinking they were onto something, a netbook was quickly specified in collaboration with their suppliers in China. Five weeks before Christmas, one week after they had noticed the spike, the product was complete and sent to testing, as well as being put up on the web site and added to the company's current advertising campaigns. That same product went on to become their biggest seller for the Christmas season.

At the same time traditional electronics retailers are struggling. The shift to online is part of the problem, but dropping retail prices are pushing down revenues and making the situation worse; customers who shop on the high street are handing over less cash for the same goods. Harvey Norman, an Australian department store, is tying to combat the problem by moving away from goods who's price is shrinking, reducing floor space for electronics and trying to shift more durable goods, such as fridges and lounge suites, who's prices are holding up better. Other retailers are experimenting with smaller store which require less floor space (with consequentially lower rents), but struggle to stock a broad enough range to products to satisfy many customers. Even the luxury brands are in trouble, with low production and distribution costs allowing unscrupulous individuals to flood the market with cheap counterfeits of well known, and highly desirable brands.

[youtube zoE4sbJMMFU]

Some companies are, however, thriving in this environment. Kogan is an obvious case, as is Apple. While the products Apple makes use the same commodity components as their competitors, as well as being assembled in the same factories and travelling in the same trucks, Apple manages to endow its product range with an aura that keeps customers coming back. Amazon has created a low cost purchasing environment that is crippling publishers while rewarding loyal customers.

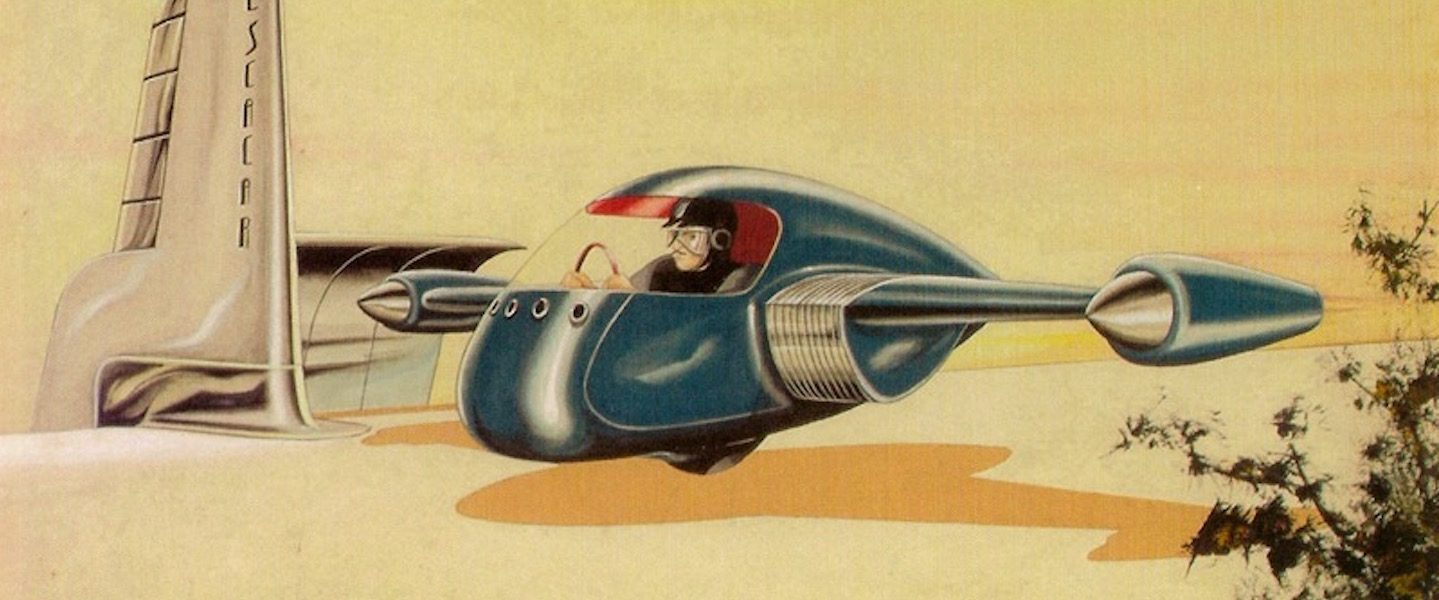

At a local level we're seeing business move from pure retail to focus on building a community that customers identify, and where the financial transactions are an incidental part of being a member of the community rather than an event the business is driving toward. The recent emergence of crowd funding tools such as Pozible{{19}} and Kickstarter{{20}} (who just funded their third project over one million dollars inside two weeks{{21}}) is just the nail in the coffin, as content and product creators realise that they don't need much more than a good idea and well presented pitch to get going, rather than the backing of a major manufacturing and distribution business. Bookshops are coming back as they realise that they are part of a community, rather than just the endpoint of a low cost distribution chain{{22}}. Even big ticket items such as cars are coming up for grabs. Delta Motorsport has applied similar thinking to develop the E-4 Coupe, a 150mph (241kph) electric sports car built with a minuscule £750,000 ($1.2m) budget and just ten employees{{23}}. Delta expect it can put the E-4 Coupe into production for £4.5m, a fraction of the $1 billion or more required via a more conventional approach.

[[19]]Tracey Lien (January 25, 2012), Will Make Games For Food… Or Funding,[[19]]

[[20]]KickStarter: We’re the world's largest funding platform for creative projects[[20]]

[[21]]Ben Popper (February 20, 2012), Kickstarter gets its third $1M project in the span of two weeks with Order of the Stick, VentureBeat[[21]]

[[22]]Carolyn Webb (February 13, 2012), New chapter for bookshops in Greensborough, The Age[[22]]

[[23]]Chris Knapman (June 3, 2011), Electric Delta E4 at Crystal Palace, The Telegraph[[23]]

Some businesses are booming, and some are struggling, and there's a good chance that we have a two speed economy. But this is not two speed in the traditional sense, where resources might be down but retail up. It's a reconfiguration of the market, a Darwinian process where companies designed around high cost manufacturing and strong distribution die out, replaced by a new generation who don't make the same assumptions. The market has definitly softened, but how much of the turmoil we seeing is due to a drop in a general consumer demand, and how much is due to a collapse in demand for the services provide by traditional businesses? Consumers have evolved, their behaviour has changed, and business needs to evolve with them.

Update: Recent figures from the Australian Bureau of Statistics show that while retail is down, cafés and restaurants are up 4.3%{{24}}.

[[24]]Peter Martin (March 1, 2012), Rate cut cash spent on dining, The Age[[24]]